RBI Holds Rates Steady, Pegs FY25 GDP at 7%, But Inflation Concerns Linger

Mumbai: In a closely watched decision, the Reserve Bank of India's Monetary Policy Committee (MPC) opted to maintain the repo rate, the key lending rate, at 6.5% during its bi-monthly meeting today. This move, largely in line with market expectations, comes amidst positive growth projections for FY25 (7%) but lingering concerns about inflation.

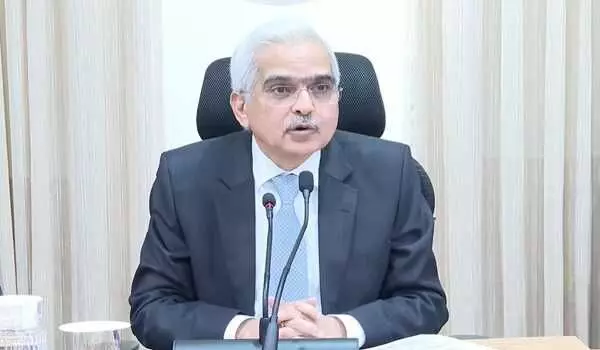

After a detailed assessment of the evolving macroeconomic and financial developments and the outlook, the Monetary Policy Committee (MPC) decided by a 5 to 1 majority to keep the policy repo rate unchanged at 6.5 per cent. Consequently, the standing deposit facility (SDF) rate remains at 6.25 per cent, and the marginal standing facility (MSF) rate and the bank rate are at 6.75 per cent," said RBI Governor Shaktikanta Das while making the bi-monthly monetary policy statement.

The MPC also decided, by a majority of 5 out of 6 members, to remain focused on the withdrawal of accommodation to ensure that inflation progressively aligns with the target while supporting growth.

Sharing the rationale for the MPC decisions, the RBI Governor said that momentum in the domestic economy continues to be strong, and headline inflation, after moderating to 4.9 per cent in October last year, rose to 5.7 per cent in December 2023.

"This was primarily due to food inflation, mostly vegetables. The softening in core inflation (CPI inflation excluding food and fuel) continued across both goods and services, reflecting the cumulative impact of monetary policy action as well as the significant softening in commodity prices. The uncertainties in food prices, however, continued to impinge on the trajectory of headline inflation. Taking into account this growth-inflation dynamics and the fact that transmission of the cumulative 250 basis points policy rate hike is still underway, the MPC decided to keep the policy repo rate unchanged at 6.5%," Shaktikanta Das said.

He further said MPC will carefully monitor any signs of generalisation of food price pressures, which can fritter away the gains in easing core inflation.

"Monetary policy must continue to be actively disinflationary to align inflation to the target of 4 per cent on a durable basis. The MPC will remain resolute in this commitment," Das said.

The RBI has projected consumer price index (CPI)-based retail inflation for the next financial year (2024–25) at 4.5 per cent. The Indian economy is expected to register 7 per cent growth in FY25, as per the RBI estimate.

Analysis:

The RBI's decision to hold rates reflects a delicate balancing act between supporting economic growth and managing inflation. While the growth outlook is encouraging, inflation remains above the RBI's target of 4% (+/- 2%). This suggests the central bank is prioritizing price stability for now, even if it means slightly slower growth.

Looking ahead, several factors will influence the RBI's next move:

Taming food inflation will be crucial to bringing overall inflation down and providing the RBI with more room to maneuver on rates.The ongoing war in Ukraine and its impact on commodity prices remain a wildcard. Assessing the full impact of past rate hikes on the economy will be key.

In conclusion, the RBI's cautious stance reflects the complex economic environment. While growth prospects are bright, inflationary pressures necessitate a measured approach. The central bank's future actions will depend on how these factors evolve in the coming months.