GST on UPI Transactions: Government Considers Imposing 18% GST on UPI Transactions Above ₹2,000

Proposal Aims to Enhance Tax Compliance as Digital Payment Platform Continues Rapid Growth Across India;

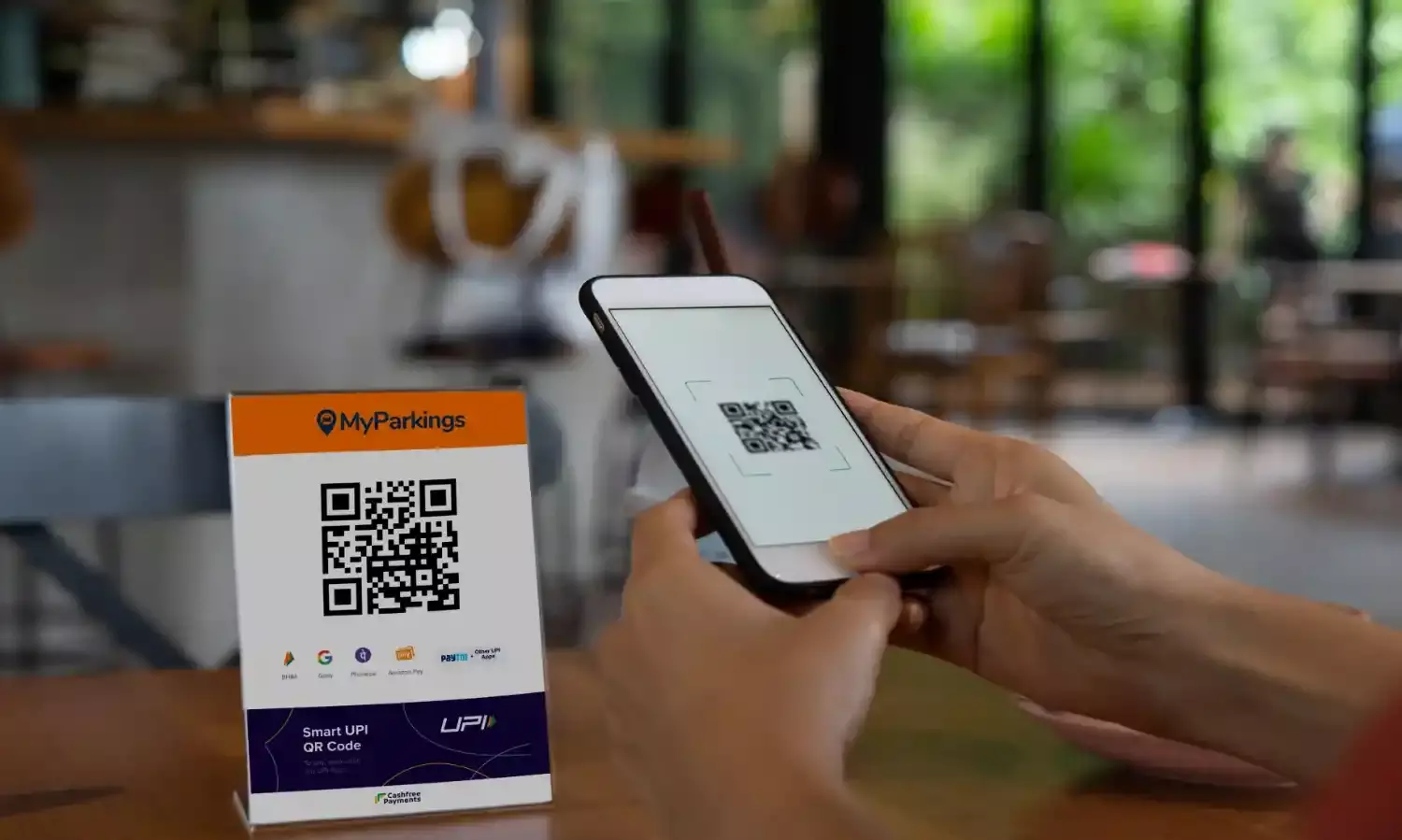

The Indian government is reportedly evaluating a proposal to impose Goods and Services Tax (GST) on Unified Payments Interface (UPI) transactions that exceed ₹2,000. According to media reports, the move would bring high-value digital payments within the tax framework as part of efforts to enhance tax compliance.

Key Details of the Proposal

Under the revised proposal, digital payments made via UPI that cross the ₹2,000 threshold in a single transaction would be subject to taxation. If approved, these transactions would likely attract the standard 18 percent GST rate currently applied to most digital services.

The proposal could affect both peer-to-peer transfers and merchant transactions conducted through the UPI platform, although no official implementation date has been announced.

Motivation Behind the Move

The primary objective behind this potential policy change appears to be bringing more digital transactions into the formal economy and strengthening tax compliance. As UPI adoption continues to grow across India, the government sees an opportunity to expand the tax base through high-value digital payments.

Current GST Performance

This proposal comes as India's GST collections continue to show robust growth. In February 2025, collections rose by 9.1 percent year-on-year to approximately ₹1.84 lakh crore.

According to official data released on March 1, the February collections included:

₹35,204 crore from central GST

₹43,704 crore from state GST

₹90,870 crore from integrated GST

₹13,868 crore from compensation cess

The government has not yet made any official announcement regarding the implementation timeline for the proposed UPI transaction tax.